Interest Costs Associated with the One Big Beautiful Bill Act

In March, The Budget Lab (TBL) published a study detailing the inflationary risks and household cost effects associated with an illustrative, permanent increase in primary federal deficits equal to 1% of GDP. Among the conclusions highlighted in that report was that higher deficits and debt result in higher interest rates and higher borrowing costs, including for home mortgages, auto loans, and small business loans.

This analysis is an update of that analysis reflecting the interest rate impacts of the One Big Beautiful Bill Act (OBBBA). It draws on the full macroeconomic and fiscal analysis of OBBBA that TBL published on June 6.

Against current law, OBBBA raises the primary (non-interest) deficit by $2.4 trillion over the next decade conventionally-scored. TBL’s economic analysis found that OBBBA temporarily boosts real GDP in the first few years, but then this effect flips to a drag on real GDP as higher debt & price pressure spur higher interest rates, first by eliciting tighter monetary policy from the Federal Reserve to sterilize the inflationary heat, and then from crowding out of private investment. TBL’s analysis found that by 2055, the 10-year nominal Treasury yield is 1.2 percentage points higher versus a current law baseline projection where the TCJA expires.

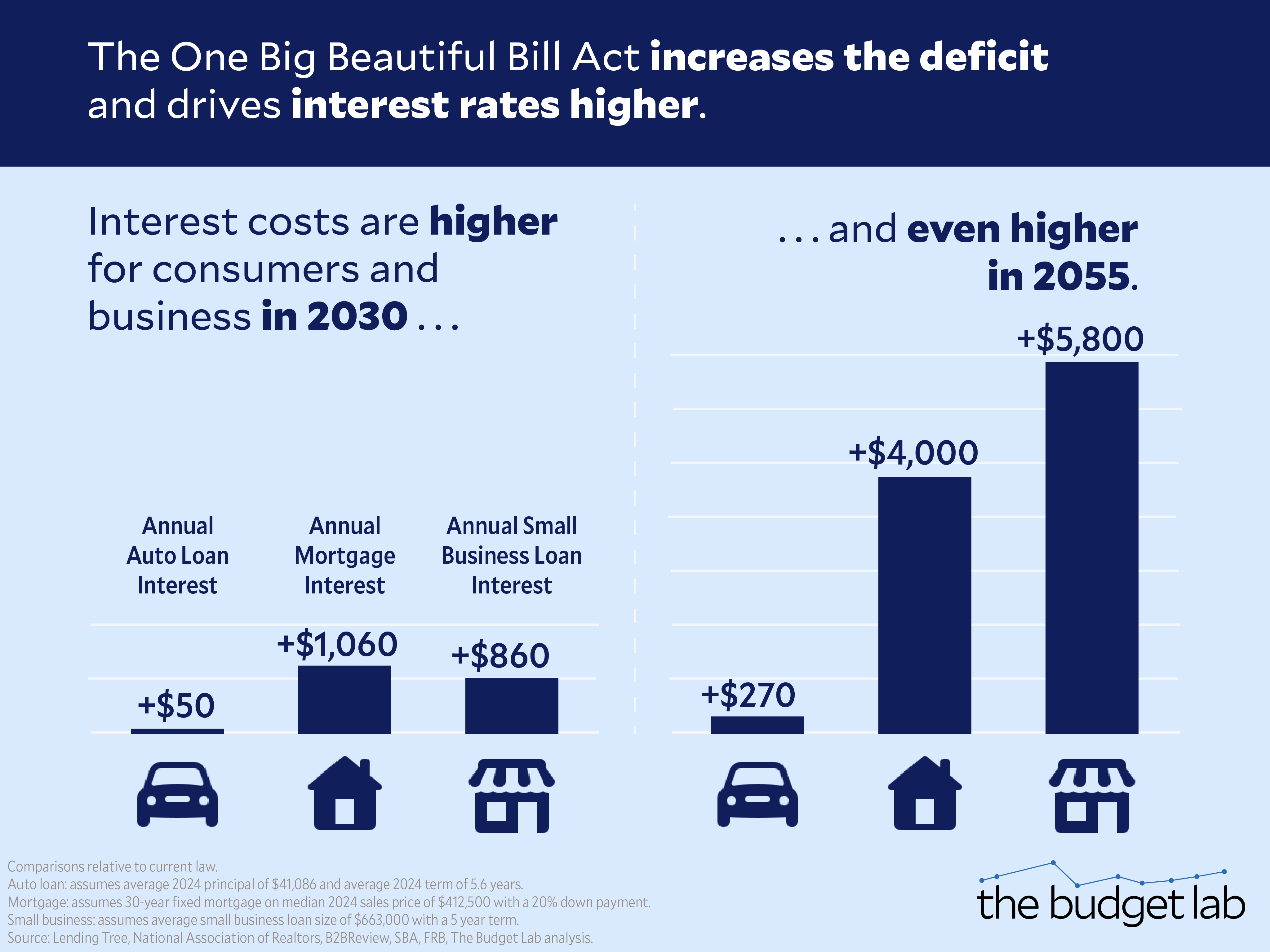

The table below and figure above translate these interest rate effects into illustrative effects on three different debt products: a conventional 30-year mortgage, a small business loan, and a new auto loan. All three use 2024 averages for both typical principal and loan term.

- Mortgages. A typical 30-year mortgage (taken out at the median 2024 home price with 20% down) would see rates rise by 0.4 percentage point as of the end of 2030, and 1.5 percentage points by the end of 2055. That translates into $1,060 and $3,990 higher annual principal & interest payments per loan, respectively, in 2024 dollars.

- Small business loans. The average 2024 small business loan balance was $663,000, with a 5 year term. TBL finds that OBBBA raises small business loan rates by 0.2 percentage point in 2030 and 1.5 percentage points in 2055, raising loan payment costs for businesses by $860 and $5,760 per loan, respectively, in 2024 dollars.

- Auto loans. The average principal on a new auto loan in 2024 was $41,086, with an average term of 67 months. TBL finds OBBBA drives auto loan rates higher by 0.2 percentage point and 1.2 percentage points in 2030 and 2055 respectively. This raises annual costs by $50 and $270 per loan, respectively, in 2024 dollars.